Make a copy of the amended return for your records. Then complete Schedule X amended return explanation.

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Simplified instructions for full-year residents amending 2020 Forms 140 140A or 140EZ Line numbers refer to Form 140X.

Irs amended return address california. On Part II line. Department of the Treasury Internal Revenue Service Fresno CA 93888-0422 Starting June 19 2021 use the following address. Colorado Department of Revenue.

If Form 1040X includes a Form 1040NR or 1040NR-EZ send it to. Attach Schedule X to your updated Form 540540NR sign the amended return and mail it to one of the addresses. Colorado Department of Revenue.

Check Your 2020 Refund Status. Department of the Treasury Internal Revenue Service Austin TX 73301-0215 USA. Franchise Tax Board PO Box 942867 Sacramento CA 94267-0001.

Box 7704 San Francisco CA 94120-7704 Starting June 19 2021 use this address Internal Revenue Service PO. Attach a cover letter explaining the changes made to the original return. 540 Scannable Franchise Tax Board PO Box 942840 Sacramento CA 94240-0001.

Virgin Islands or the Northern Mariana Island see Pub. Amend an income tax return. Mail all documents including any additional payment owed to.

Franchise Tax Board PO Box 942840 Sacramento CA 94240-0040. California Department of Tax and Fee Administration PO Box 942879 Sacramento CA 94279-7072. Department of the Treasury Internal Revenue Service Fresno CA 93888-0422 Starting June 19 2021 use the following address.

Refer to our frequently asked questions for more information. Internal Revenue Service PO. Addresses by state for Form 1040 1040-SR 1040ES 1040V.

The correct amount to enter on line 6C is the total amount of charitable contributions made in 2020 for which you are claiming a tax credit for the current tax year 2020 or prior tax year 2019. This may cause a delay in processing your amended return and an y claim for refund. Tax Forms Development and Distribution MS F-284 Franchise Tax Board PO Box 1468 Sacramento CA.

You cannot eFile a CA Tax Amendment anywhere except mail it in. Department of the Treasury Internal Revenue Service Ogden UT 84201-0052. Call our toll-free number only when the tool asks you to contact us.

Dec 10 2020 Internal Revenue Service Austin TX 73301-0215 USA. Refund Amount Whole dollars no special characters. Sacramento CA 94267-0001.

540 2EZ line 32. Use this address if you file January 1 2021 through June 18 2021. Internal Revenue Service Austin TX 73301-0052.

Franchise Tax Board PO Box 942867 Sacramento CA 94267-0001. IRS telephone assistors dont have any additional information about your amended return while it is processing. FRANCHISE TAX BOARD PO BOX 942867 SACRAMENTO CA 94267-0001.

Jan 01 2015 Dependent Exemption Credit with No ID If you are amending a return to claim the dependent exemption credit for tax years 2018 and 2019 complete an amended Form 540 Form 540NR or Form 540 2EZ and write no id. Use this address if you file January 1 2021 through June 18 2021. In the SSN field on the Dependents line and attach Schedule X.

Jun 04 2021 The amended return tool cant access certain amended returns. Internal Revenue Service Austin TX 73301-0052. When you amend your tax return you may either have to pay more in taxes or receive a refund.

Apr 12 2021 The main IRS phone number is 800-829-1040 but this list of other IRS numbers could help you skip the line spend less time on hold or talk to a human faster. Little Rock AR 72203-3628. FRANCHISE TAX BOARD PO BOX 942840 SACRAMENTO CA 94240-0002 If you owe mail your return and check or money order to.

Arizona Amended Return Notice. Department of the Treasury Internal Revenue Service Ogden UT 84201-0052. Help with an amended return.

Denver CO 80261-0006. Sacramento CA 94240-0001. 3 rows Individual Tax Returns by State.

If you are due a refund or have no amount due mail your return to. To complete Schedule X check box m for Other. Refund amount claimed on your 2020 California tax return.

Box 802501 Cincinnati OH 45280-2501. 7 rows Jun 30 2021 Fresno CA 93888-0002. Starting June 19 2021 use this address.

The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version as of the date of certification published by the Web. Arkansas State Income Tax. If you live in American Samoa Puerto Rico Guam the US.

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

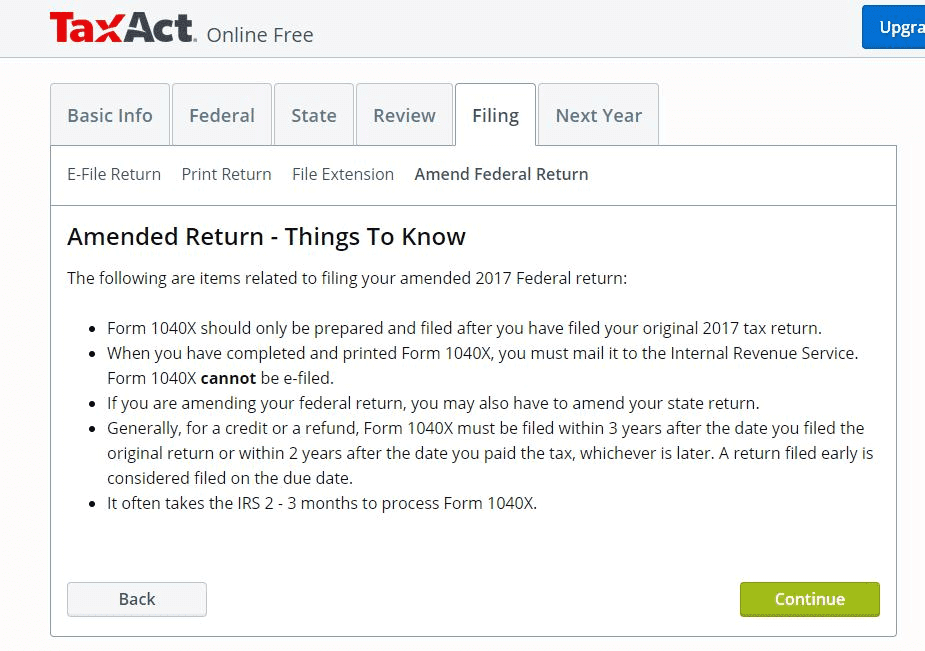

Tips For Filing An Amended Tax Return 1040x Taxact

Tips For Filing An Amended Tax Return 1040x Taxact

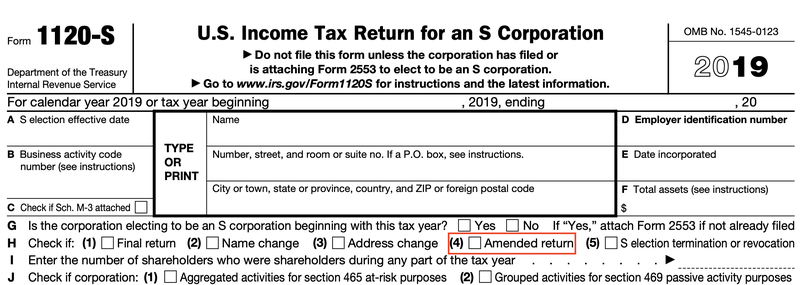

How To File An Amended 1120 S With The Irs The Blueprint

How To File An Amended 1120 S With The Irs The Blueprint

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

3 10 72 Receiving Extracting And Sorting Internal Revenue Service