Individual Income Tax Return for this year and up to three prior years. OnLine Taxes Amended Return Services Click on the amended type you are needing and we will list further information for you.

Amended Tax Return Form 1040 X Can Now Be E Filed Tax Practice Advisor

Amended Tax Return Form 1040 X Can Now Be E Filed Tax Practice Advisor

Check Tax Amendment Status You can also call the IRS amended return hotline at 1-866-464-2050.

Irs amended return online. Make changes to your 2020 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312023. Wheres My Refund. Use of this system constitutes consent to monitoring interception recording reading copying or capturing by authorized personnel of all activities.

From there the software will walk you through the process of filing the amendment. Online tool to check the status of their. Online service does not track the status of amendment refunds.

GOVERNMENT SYSTEM IS FOR AUTHORIZED USE ONLY. Aug 17 2020 Major IRS milestone helps taxpayers correct tax returns with fewer errors speeds processing. Apr 29 2021 You can check the status of your Form 1040-X Amended US.

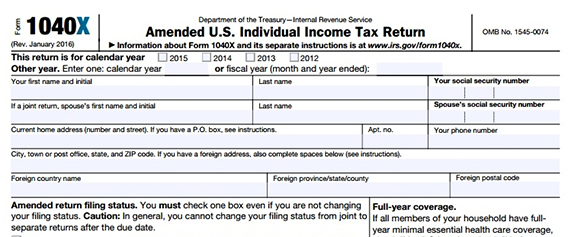

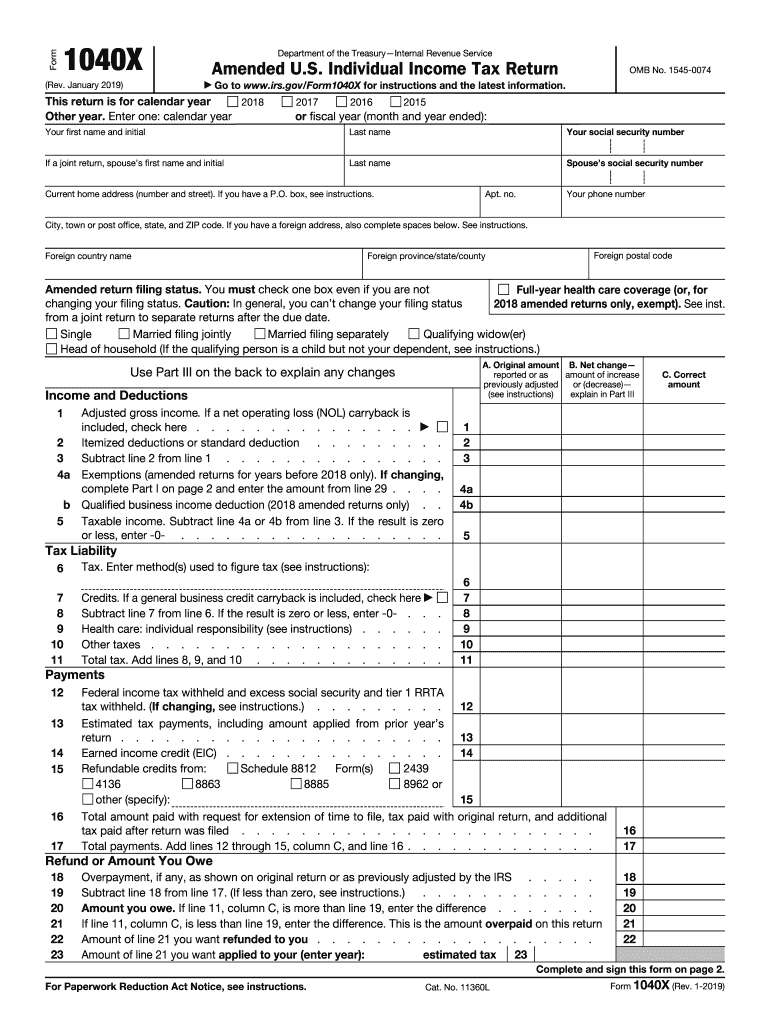

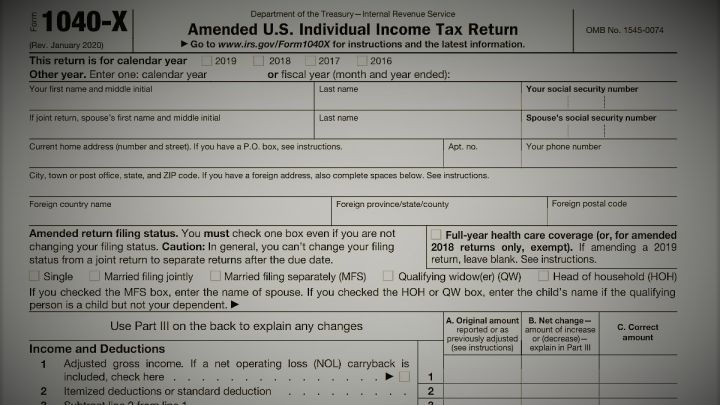

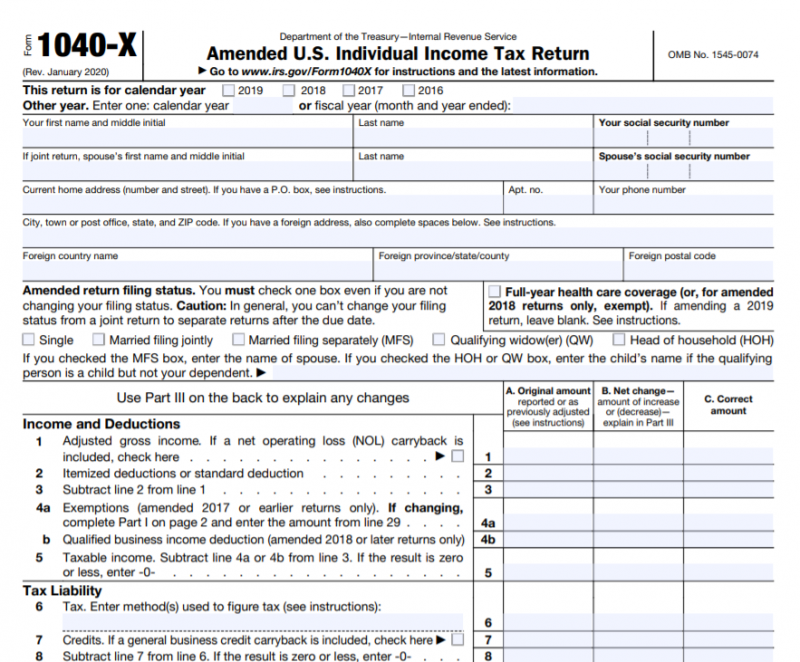

You can use this form to report corrections to your filing status income deductions credits or tax liability. Individual Income Tax Return. OnLine Taxes will help you file amended returns for both your federal and state income tax returns if needed.

1 day ago The IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool will not likely provide information on the status of your unemployment tax refund. Online tool or by calling the toll-free telephone number 866-464-2050 three weeks after you file your amended return. Oct 16 2018 If you prepared your original tax return using TurboTax log in to your account open the tax return you already filed and click on the link to amend your return.

WASHINGTON Marking a major milestone in tax administration the Internal Revenue Service announced today that taxpayers can now submit Form 1040-X electronically with commercial tax-filing software. How to find my. When do I need to file an amended tax return.

Apr 07 2021 An amended tax return is Form 1040-X. Electronic filing will allow faster receipt and fewer errors on amended returns the IRS says. The IRS has an online tool for checking on your amended tax return called Wheres My Amended Return The website also lists a toll-free automated phone.

As IRS e-filing has grown during the past 30 years the 1040-X Amended US. This is my first time filing an amended return. Jun 04 2021 Check the status of your Form 1040-X Amended US.

Individual Income Tax Return using the Wheres My Amended Return. That is a big deal since up to now every amended tax return had to be. Sometimes the IRS makes changes to a return on its own.

Go to the Overview of the HR Block Online product. During that time you can also prepare a 2020 Tax Amendment and soon you will also be able to e-File the Form 1040-X. Sep 21 2020 The IRS also began accepting electronically filed 1040-X forms in summer 2020.

Aug 24 2020 Those filing their Form 1040-X electronically and on paper can use the. Jun 01 2020 The IRS has announced that this summer for the first time you can amend your tax return file Form 1040-X electronically. Wheres My Amended Return.

Your amended return will take up to 3 weeks after you mailed it to show up on our system. This will be visible only after you e-file your original return and its been accepted by the IRS. Im not holding my breath though because the IRS says it takes up to 16 weeks and that wont be until 722.

For now amendments to forms 1040 and 1040-SR can be filed electronically only for the 2019 tax year. Individual Income Tax Return. The IRS has a special form for just that purpose the Form 1040-X Amended US.

For TurboTax Live Full Service your tax expert will amend your 2020 tax return for you through 11302021. May 03 2021 Filers can check the status of a paper or electronically filed Form 1040-X Amended Return using the Wheres My Amended Return WMAR online tool or the toll-free telephone number 866-464-2050 three weeks after filing the return. Choose the option to file an amended return.

Processing it can take up to 16 weeks. If you are amending a return in order to get an additional tax refund you can go ahead and cash or deposit any refund you get in the meantime. Sep 25 2018 To file an amended return online.

Both tools are available in English and Spanish and track the status of amended returns for the current year. I filed on 41 and it started showing up as received a couple of weeks after that and has made no progress since. Terms and conditions may vary and are subject to change without notice.

Where S My Amended Return 7 Points One Must Know Internal Revenue Code Simplified

Where S My Amended Return 7 Points One Must Know Internal Revenue Code Simplified

Irs 1040 X 2019 Fill And Sign Printable Template Online Us Legal Forms

Irs 1040 X 2019 Fill And Sign Printable Template Online Us Legal Forms

Tax Filing 2021 How To File An Amended Tax Return As Com

Tax Filing 2021 How To File An Amended Tax Return As Com

Irs To Provide Electronic Amended Tax Return Filing Option This Summer Penbay Pilot

Irs To Provide Electronic Amended Tax Return Filing Option This Summer Penbay Pilot