Mar 31 2021 Return Received Notice within 24 48 hours after e-file. Mar 16 2021 On the Lets get ready to e-file screen select File by mail then on the next screen make sure you select Change for federal and all of your states.

How Do I Clear And Start Over In Turbotax Online Turbotax Support Video Youtube

How Do I Clear And Start Over In Turbotax Online Turbotax Support Video Youtube

You have a partnership own an S or C Corp Multi-Member LLC manage a trust or estate file a separate tax return for my business.

Where do i mail my federal tax return turbotax. The IRS states For supporting statements arrange them in the same order as the schedules or. There are required Form 1040 attachments but it is not necessary to send all documents used in your preparation. You can amend your state tax return in two simple steps.

Many states also use the X suffix for the form number. These services are provided only by tax experts or CPAs. Jun 05 2019 Yes you would want to attach any forms to your return that show income tax withheld.

One year from the final determination of the amended federal return or federal change whichever is later provided that the allowable refund is not more than the decrease in Kansas tax attributable to the federal change or correction. Second get the proper form from your state and use the information from Form 1040X to help you fill it out. For example California uses Form 540X and Hawaii uses Form N-188X.

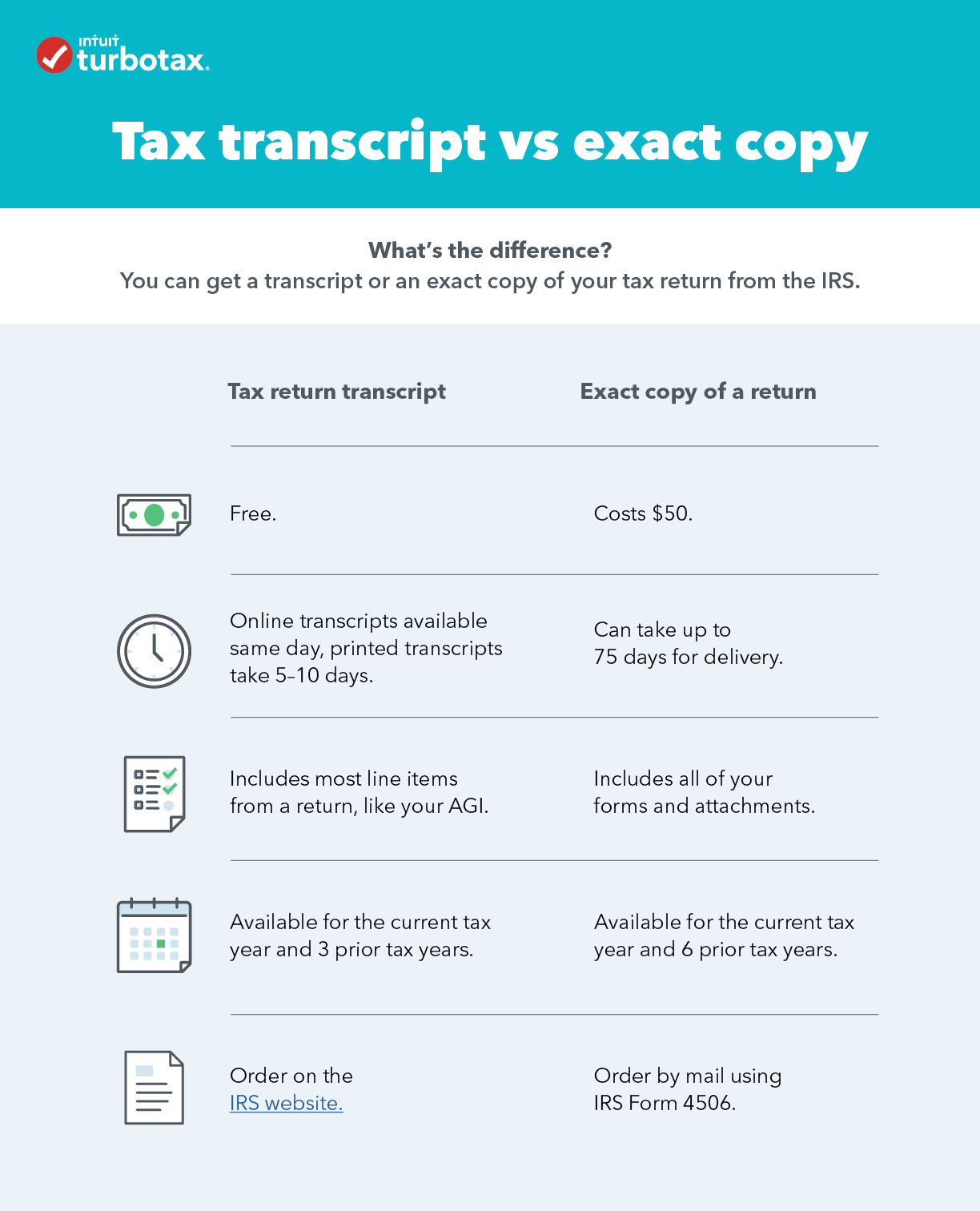

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. Jun 12 2018 Taxpayers can use Get Transcript by Mail or call 800-908-9946 to order a tax return transcripts and tax account transcripts. However if your 1099s doesnt show any income tax withheld you dont need to attach themMake sure your sign your return because it will not be valid unless your signature is on it.

TurboTax Has You Covered. If you filed your 2019 tax return using tax preparation software like TurboTax or HR Block follow the instructions in the software to amend and e-file your return. TurboTax Business is recommended if.

May 03 2021 Find out if Your Tax Return Was Submitted. Mail your federal return to the Internal Revenue Service Center listed for the state that you live in. For any year before 2019 you still need to mail the paper forms.

You should mail each year in separate envelopes. Reasons You Need to File an Amended Virginia Income Tax Return Changes to Your Federal Return. In order to file by mail youll need to instead pay with a.

May 25 2021 Lastly remember when you amend your federal tax return you may need to amend your state tax return since some states follow Federal tax law. If you or the IRS changes your federal return youre required to fix or correct amend your Virginia return to reflect the changes on your federal return within one year of the final determination date of the federal change. Like the IRS your state uses a special form for an amended return.

First fill out an amended federal income tax return Form 1040X. Access to tax advice and Expert Review the ability to have a Tax Expert review andor sign your tax return is included with TurboTax Live or as an upgrade from another version and available through December 31 2021. First fill out an amended federal income tax return Form 1040X.

To file a federal amended return. Three years from the due date of the original tax year return including valid filing extensions. They should use Form 4506-T to request other tax records such as a tax account transcript record of account wage and income and a verification of non-filing.

Once you prepare your federal amended return you must print and mail Form 1040X even if you e-filed your. You can check the status of your amended return with the IRS using the Wheres My Amended Return tool. You will need the following information when checking refund status.

Complete and send either 4506-T or 4506T-EZ to the IRS. For the Federal mailing addresses Click. Social security number or ITIN your filing status and your exact federal tax refund amount shown on.

The zip code will identify it as going to the IRS. Dont worry about knowing these steps for amending your tax return. Check the forms instructions for where to mail your return.

Nov 03 2020 To amend something means to change it and thats exactly what you do when you file an amended tax return. You can file your tax return by mail through an e-filing website or software or by using the services of a tax preparer. There is no street address.

Tool will show Return Received status once they begin processing your tax return. You change your tax return to reflect new information. Youll see the option to file an amended return at the bottom of the screen after your return is re-filed and accepted.

Like the IRS states typically use a special form for an amended return. Includes 5 free federal e. May 04 2021 Tax Advice Expert Review and TurboTax Live.

If the File by mail option isnt available you probably previously selected to pay your TurboTax fees through your tax refund. The zip code indicated in the chart below is exclusive to the corresponding IRS processing center. Filing an amendment may seem confusing because you must complete extra forms in addition to the original 1040.

Nov 02 2018 The Internal Revenue Service requires you to submit most forms and schedules used to prepare paper returns. Follow the directions to amend your return. The state processing times vary from state to state.

Although the tax information you receive each year and the forms and items you use to calculate your return all appear to be things you should attach there. Using the IRS Wheres My Refund tool. Apr 13 2016 If you are amending more than one tax return prepare a 1040X for each year.

Go to your Dashboard or Main Menu. You will mail the Federal and State Amended Returns separately. Then get the proper form from your state and fill it out.

Viewing your IRS account information. Note that starting with 2019 tax returns the IRS now allows you to electronically file Form 1040X. The processing time for the Federal Amended Return is approximately 12 weeks from the time you mail the return.

May 04 2021 How do I amend my state tax return. Attach other forms with changes. The IRS Wheres My Refund.

Note the tax year of the return you are amending at the top of Form 1040X. Anytime you need to change your filing status income deductions or. May 04 2021 Amending your state tax return.

The state amended return can be found at the end of the printed documents.

Where S My Tax Refund The Turbotax Blog

Where S My Tax Refund The Turbotax Blog

2021 Irs Tax Refund Schedule Direct Deposit Dates 2020 Tax Year

2021 Irs Tax Refund Schedule Direct Deposit Dates 2020 Tax Year

How To Contact The Irs If You Haven T Received Your Refund